Commodities-backed Currency Competition as the revolt of the Squeezed Real Economy

We wake up these days with news about farmers unrest across Europe. Back in 2009, when I first heard about cryptocurrencies, I have the expectation that they were coming to boost the Real Economy. The fact is that, after 15 years, just a few tokens in Supply Chain and tokenization, with no real use cases, have been created. And their purpose was, not to become currencies, but instead to become some kind of good identifiers for traceability in their ecosystems.

If we inspect where VCs have put their funds during the last years, we can see there is barely funding to Real Economy. Instead, VCs have made their toy of blockchain and crypto.

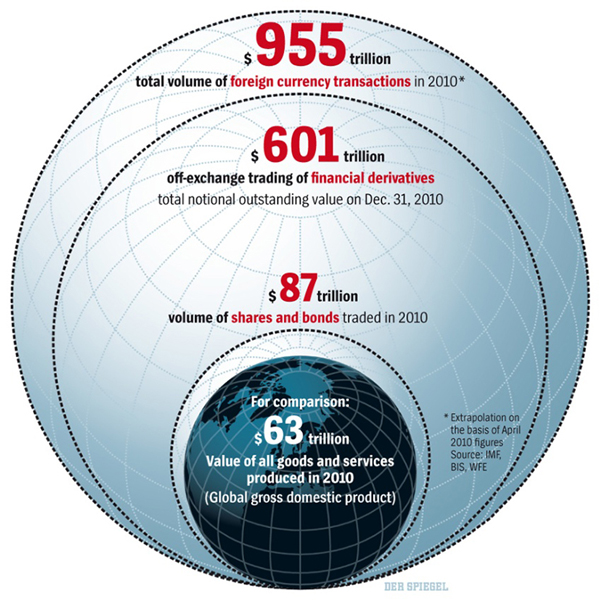

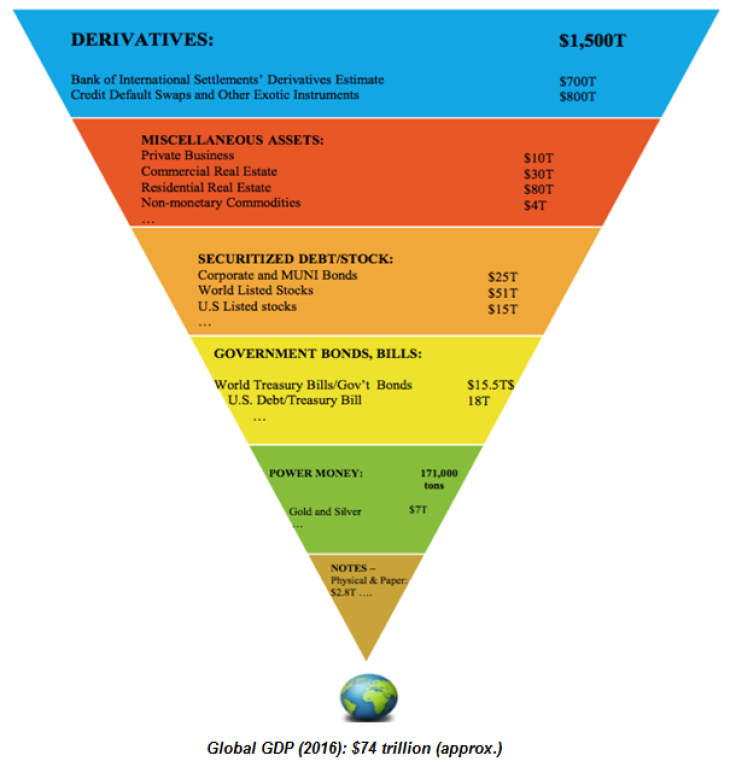

If we zoom out of the blockchain/crypto industry to the global economy, we can see how the Real Economy of goods and services has became a pet of the Financial Economy of securities and derivatives.

|  |

On the other hand, most of citizens make their living in the Real Economy but buy their houses at prices of the Financial Economy.

If, according to Austrian Economics, wealth comes from commodities and money is only a Medium of Exchange for real world transactions, with the advent of electronic money, what prevents Real Economy providers to issue cryptocurrencies by capturing the wealth of commodities as perceived by customers and use them to fund their projects providing financial services to their communities?

Can someone provide an insight on this?